What is a mortgage broker and what do they do?

Savrr.com is a trading name of Fair Comparison Pty Ltd. Comparison tables are powered by Fair Comparison Pty Ltd who do not compare every provider in the market, or all products from the displayed providers. Fair Comparison Pty Ltd does not give recommendations, advice or credit assistance and may receive a fee if you, apply, click through, or successfully qualify, for a product displayed.

Learn More

Many Australians might choose to get a helping hand when taking out a home loan, seeking out the services of a qualified mortgage broker who can help them through the selection and application process.

If this is an option that sounds appealing to you, here’s some more information about what mortgage brokers are, what they do and how they might be able to help you.

What is a mortgage broker?

A mortgage broker is a licenced person who works with a range of banks and lenders to help borrowers secure home loans. While brokers are generally paid a commission by a lender for arranging a loan, when suggesting a loan product a mortgage broker must act in your best interest.

What does a mortgage broker do?

Mortgage brokers work on the borrower’s behalf to arrange the finance for them to purchase a home.

Brokers will assess their customers' borrowing power, and provide guidance on how to improve their chances to secure a home loan, compare home loan products from a number of different lenders on the borrower’s behalf and help manage the mortgage application process all the way to settlement.

For first time home buyers, a mortgage broker can also help assist you through the home loan process by explaining how the process works, and how to achieve your property goals. They may also be able to assist you with applying for government grants you may be eligible for.

Buying a property can be a complicated process and a broker can potentially help explain some of the steps and lingo along the way. These might include:

Explaining your credit score

A credit score is a number that helps represent your trustworthiness as a borrower. If you have ever had a personal loan, car loan or credit card, lenders will assess this score to help determine your ability to make repayments on a mortgage.

A broker may be able to help you understand what your score is, how you can improve it and/or how it could impact your ability to secure a home loan.

Borrowing power and aligning your property goals

Mortgage brokers may also assist you in understanding what you can afford, by crunching the numbers on your income, expenses and savings to help determine your borrowing power. This can help align your expectations with realistic outcomes of what type of property you might be best-suited to look at.

Explain products such as fixed or variable home loans

Lenders offer different products which will impact you as the borrower. Brokers may help guide you in finding a product that suits you.

A home loan is broken down into two parts; the principle, which is the amount you borrow, and the interest, which is what the lender charges you for the benefit of lending you money.

Home loans are either a fixed rate or variable rate home loans, though a loan can also be split to be a mix of both. If the interest rate is fixed, it stays the same for a set period of time (often between two and five years). If it is variable, that means it is subject to change as the market rises and falls.

Brokers may be able to help you understand the risks and rewards of these home loan products and which may align with your property goals and financial situation more closely.

Explain home loan features

Both fixed and variable rate home loans come with a range of features. These depend on the lender and your financial circumstances.

Home loan features such as redraw facilities and offset accounts can help offer more financial flexibility, so these may be features you speak with a mortgage broker. If there are particular features that are important to you, you may even request to only look at home loans with these specific features.

As a customer, it’s important to understand brokers may have partnerships with lenders and may also receive commissions from lenders for securing customers. However there are requirements in Australia that reinforce that the broker must disclose the commission they will be paid for a loan and the lenders they work with.

Should you use a mortgage broker in Australia?

The decision to use a mortgage broker may depend on your financial knowledge, and confidence in navigating the lending market on your own. For many first home buyers, a mortgage broker may be able to provide help when dealing with complex credit products.

The home loan market is flooded with thousands of home loan products, and a broker may help find a product suited to your financial situation.

You do, of course, have the option of comparing a range of home loans yourself. Our home loan comparison guide can help you get started, with some of the key fees and features to be aware of and questions to ask.

BankVic - Fixed Rate Home Loan

Fixed | Fixed for 2 years | Owner Occupied | Principal & Interest | LVR up to 80% | Borrowing between $20,000 and $2,000,000

Advertised Rate

Comparison Rate

Repayment

BankVic - Fixed Rate Home Loan

Fixed | Fixed for 3 years | Owner Occupied | Principal & Interest | LVR up to 80% | Borrowing between $20,000 and $2,000,000

Advertised Rate

Comparison Rate

Repayment

IMB Bank - Fixed Rate Home Loan

Fixed | Fixed for 2 years | Owner Occupied | Principal & Interest | LVR up to 95% (with LMI) | Borrowing more than $10,000

Advertised Rate

Comparison Rate

Repayment

Do Aussies trust mortgage brokers?

According to research from Deloitte, more than half of all new residential loans approved in the year to March 2019 were originated by third parties, including mortgage brokers.

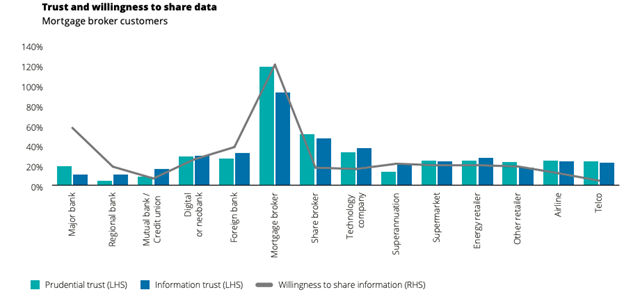

The chart below shows the incremental score of customers who used a mortgage broker compared with all other customers (i.e. those who obtained their mortgage directly from their bank). It also looks at their incremental willingness to share data.

The report indicates Australians are willing to trust mortgage brokers with their data compared to other financial industries.

How much do mortgage brokers charge?

Mortgage brokers are usually paid by the home loan lender. This means as the borrower, you may not have to pay the mortgage broker a fee, as they are generally paid a commission by lenders for written loans. It’s always important to ask your broker about fees and how they are paid commission. They are required to proactively share this information with you.

What kind of certification should a mortgage broker have?

Trying to find the right broker can be a challenge, but there are some key qualifications they require in order to provide a licenced mortgage broker service.

A mortgage broker must hold a minimum qualification of a Certificate IV in Finance and Mortgage Broking and hold or be authorised by an Australian Credit License (ACL), from the Australian Securities and Investments Commission (ASIC).

Brokers are also required to disclose information to customers such as the lenders they most frequently refer business to. This can help you understand a potential conflict of interest.

As a customer, you are also able to compare home loan products recommended by your broker, to other products in the market. This may help give you peace of mind that you are being steered in the right direction to products that are suitable for you.

Pros and cons of using a mortgage broker in Australia?

Finding a home loan yourself, without the help of a broker is often referred to as ‘going direct’. Many Aussies will choose to go direct through their bank they use for other financial products like debit and credit cards, or choose to compare a range of home loans from other lenders and apply without the assistance of a broker. If you are considering using a mortgage broker, here are some of the pros and cons you may want to consider:

Pros of using a mortgage broker

Getting a competitive rate

Banks and non-bank lenders want to secure the business of the broker and subsequently their customers, so they may be willing to provide a discounted rate for continued business on loans taken out via a broker.

This can potentially mean a broker is able to negotiate a better deal than you would be able to find yourself.

Mortgage brokers often work closely with lenders, so they may have access to special interest rates and deals the average home buyer doesn't.

Using a mortgage broker can cost you nothing

Often there is no direct cost for using a mortgage broker, so getting some home loan product suggestions can be a way to dip your toe in the water.

If they help you secure a loan with a low interest rate and great features, then that’s a plus. However if you aren’t happy with the products they are suggesting, you can walk away and go compare a range of home loans yourself.

The structure of the system means you don’t have to invest financially unless you are happy with the product they find.

Help for inexperienced buyers

If you are navigating the property market for the first time, chatting with a mortgage broker can help you understand some of the concepts of home ownership.

For many, concepts like fixed and variable rates, offset accounts and redraw facilities might not be terms you are familiar with. In this instance, having a professional explain these concepts and help you understand which are relevant for you can be a big help.

They can do some of the heavy lifting

For many, a full time job and other commitments like family, hobbies and leisure can leave little time to navigate the property market. Having a mortgage broker can be a way to leave the researching, calculating and number crunching to a professional.

Cons of using a mortgage broker

Potential conflict of interest

It’s important to remember mortgage brokers are paid by lenders. This could be considered a conflict of interest by some, however there are measures in place to help protect the customer.

In response to findings from the Royal Commission into banking, superannuation and financial services industry, the Government passed legislation to create a duty for mortgage brokers to act in the best interests of their consumers and require mortgage brokers to prioritise the interests of a customer over other interests where there may be a conflict.

Reaching out to friends or family who may have used a broker in their property buying process may help you decide if a broker is trustworthy, as well as checking their qualifications and experience.

Limited selection of home loans

It’s worth keeping in mind that mortgage brokers generally work with a selection of lenders and home loans, meaning you’re unlikely to get a full picture of loans available across the entire lending market. However, it may or may not be as wide as the scope of research that you are prepared to conduct yourself.